7 Tips on How to Pay Off Your Home Loan Early and Save More than One Hundred Thousand Dollars in Interest

Purchasing a home is a significant milestone, but the burden of a home loan can weigh heavily on your financial future. The good news is that there are strategies to pay off your home loan early, allowing you to save a substantial amount of money on interest payments. In this article, we will explore several effective methods tailored for the Australian mortgage market, each designed to help you pay off your home loan sooner and maximise your savings.

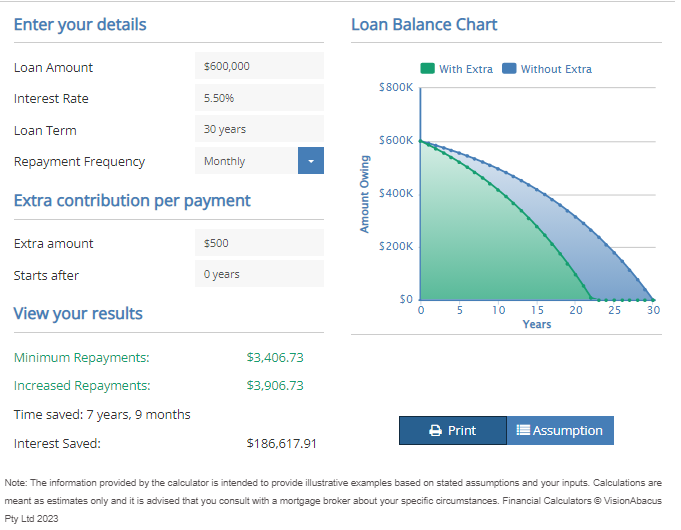

Method 1: Make Extra Repayments

One of the most straightforward ways to pay off your home loan early is by making extra repayments whenever possible. By contributing more than the required minimum each month, you can significantly reduce the principal amount owed and ultimately save on interest. Let’s consider an example:

Assuming you have a $600,000 home loan with a 30-year term and an interest rate of 5.5%. By making an additional monthly repayment of $500, you can save approximately $186,617 in interest and reduce the loan term by just under 8 years. These savings can vary based on the specific terms of your loan, but the concept remains the same: the more you contribute, the faster you’ll pay off your loan.

Use this Extra Repayments Calculator to determine how quickly you can pay off your home loan.

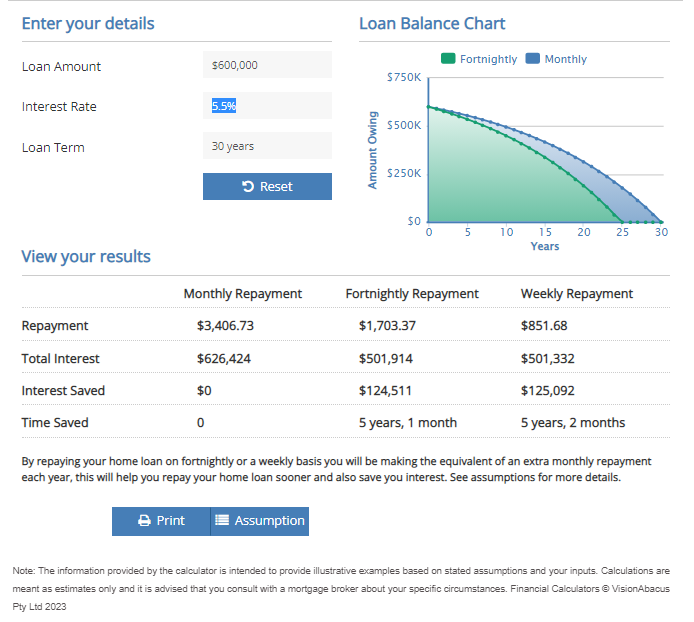

Method 2: Divide the Monthly Repayment by 2 and Pay Fortnightly

Another effective strategy to pay off your home loan early is

to divide your required minimum monthly repayment by 2 and pay that amount

fortnightly. By aligning your repayment schedule with your income cycle, you

can make more frequent payments, reducing the outstanding balance sooner.

Here’s an example:

For a $600,000 home loan with a 30-year term and an interest rate of 5.5%, if the required minimum monthly repayment is $3,407, paying $1,703 every fortnight would save you approximately $124,511 in interest and shorten the loan term by 5 years and 1 month.

Test this on your home loan by using this Fortnightly and Weekly Repayment Calculator.

Method 3: Divide the Monthly Repayment by 4 and Pay Weekly

Like the previous method, you can divide your required

minimum monthly repayment by 4 and pay that amount weekly. By making weekly

payments, you further accelerate the reduction of your loan balance. Let’s

illustrate the impact:

Using the same example of a $600,000 home loan with a 30-year term and an interest rate of 5.5%, if the required minimum monthly repayment is $3,407, paying $852 every week would save you approximately $125,092 in interest and shorten the loan term by 5 years and 2 months.

Test this on your home loan by using this Fortnightly and Weekly Repayment Calculator.

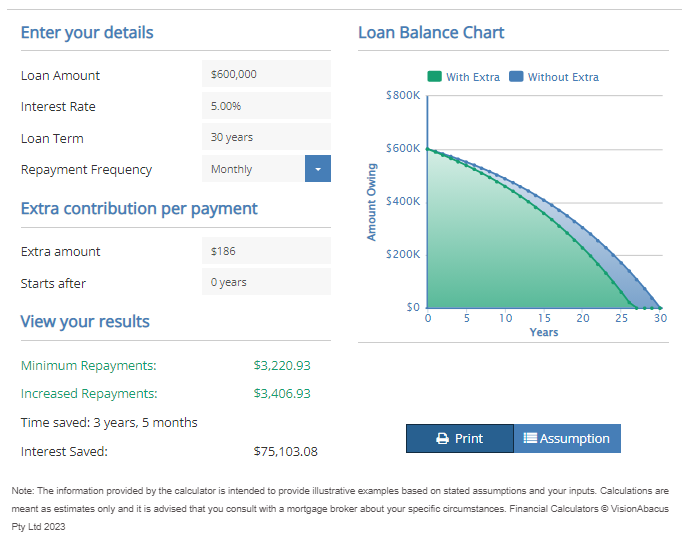

Method 4: Find a Lower Interest Rate

Finding a lower interest rate is another strategy to pay off

your home loan early. By refinancing your mortgage or negotiating with your

current lender for a better rate, you can reduce your monthly repayments and

save on interest over the life of the loan. The exact savings will depend on

the interest rate reduction obtained.

For example, if the interest rate is reduced by 0.50% p.a.

to 5.00% p.a. while maintaining the same repayment of $3,407 per month, you can

reduce the loan term by almost 3.5 years and save $75,103 in interest.

Contact us using the form below if you would like to find out if you can obtain a lower interest rate

Method 5: Avoid an Interest-Only Loan

Opting for an interest-only loan means you’re not making any progress in paying down the principal amount. Avoiding an interest-only loan and opting for a principal and interest loan from the start ensures that you’re actively reducing the loan balance, helping you pay it off sooner and saving on interest.

Method 6: Purchase an Investment Property

Investing in real estate can be a wise financial move and may also help you pay off your home loan early. By using the equity in your current home to purchase an investment property, you can generate additional income that can be used to make extra repayments on your home loan. This strategy accelerates the repayment process and helps save on interest.

Additionally, if the investment property grows in value, it can be sold in the future, and the net proceeds may be sufficient to pay off your home loan. Property in Australian capital cities has typically doubled in value every 10 to 15 years. If this were to continue, it is quite possible that the capital growth could potentially pay off your home loan in full after the investment property is sold.

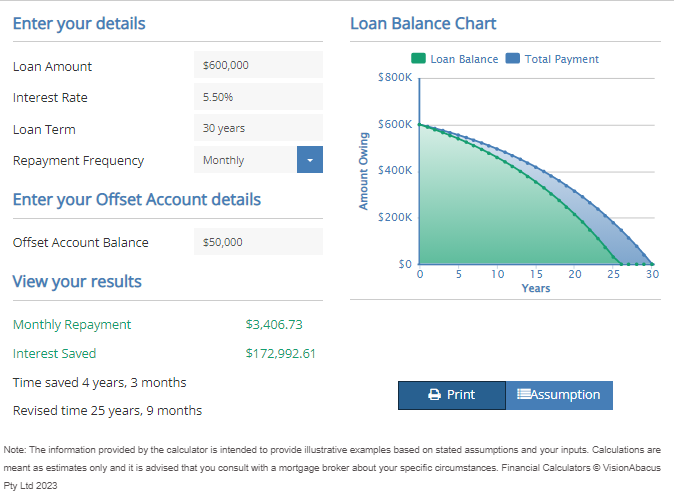

Method 7: Use a 100% Offset Account

Another powerful strategy to help you pay off your home loan early is to use a 100% offset account. An offset account is a savings or transaction account linked to your home loan. The balance in the offset account is subtracted from your loan balance, reducing the amount of interest charged. For example:

If you have a $600,000 home loan at 5.5% p.a. with a 30-year loan term, having $50,000 in the offset account from day one of the loan can reduce the loan term by 4 years and 3 months, saving you approximately $172,992 in interest. Additionally, you can leverage a credit card with an interest-free period for your normal living expenses while your money sits in the offset account, further reducing the interest charged. However, it’s crucial to pay off the full balance of the credit card every month by the due date to avoid interest charges on the credit card itself.

Use this Home Loan Offset Calculator to determine how much time and interest you can save on your home loan.

Further resources:

Here are some further resources on how to pay off your home loan early and save interest:

Conclusion:

Paying off your home loan early can provide substantial

financial benefits, allowing you to save thousands of dollars in interest. In

the Australian mortgage market, there are several effective methods to achieve

this goal. By making extra repayments, opting for fortnightly or weekly

repayments, finding a lower interest rate, avoiding an interest-only loan,

purchasing an investment property, and making extra lump sum repayments, you can

significantly reduce your loan term and save a considerable amount of money on

interest payments.

Remember, the examples provided in this article are based on

a $600,000 home loan with a 30-year term and an interest rate of 5.5%. Your

specific circumstances may differ, so it’s essential to consult with your

mortgage provider to understand how these strategies can be applied to your

situation.

Start implementing these methods today and take control of

your home loan repayment journey. With discipline and determination, you can

achieve the dream of owning your home outright and enjoy the financial freedom

it brings.

Patrick is a Director and a Home Loan Specialist. He has been helping Australians with home loans since 2001. Prior to working as a mortgage broker Patrick was employed by Macquarie Bank for 3 years and also worked as an accountant for a publicly listed company. Patrick’s qualifications include:

Bachelor of Business, UTS Sydney. Majored in accounting and sub-majored in Finance and Marketing.

Diploma of Finance and Mortgage Broking Management FNS50310

Certificate IV in Financial Services (Finance/Mortgage Broking) FNS40804

Ready to Take the Next Step?

Whether you’re looking to buy your first home, refinance, or explore investment opportunities, Mortgage World Australia is here to help.

Fill out the contact form below, and one of our expert mortgage brokers will be in touch shortly to discuss your needs and guide you through your options.

Get Started Today!