Welcome to 2024. After all the rate rises we’ve had in the last two years, we’re all looking at our expenses a little differently. We are realising how much we are paying in interest, and that the only way to stop paying that interest and put it in our own pocket is to pay off our debts and pay out our mortgage early.

Clients often ask me what strategies I’d use to pay off a mortgage faster. When they ask this I know they are serious about their financial future and setting themselves up for the long term. Clearing Debts and Paying Off your Home Loan Early gives you more freedom with your finances and gives openings for more avenues for other investments.

Here’s what to do:

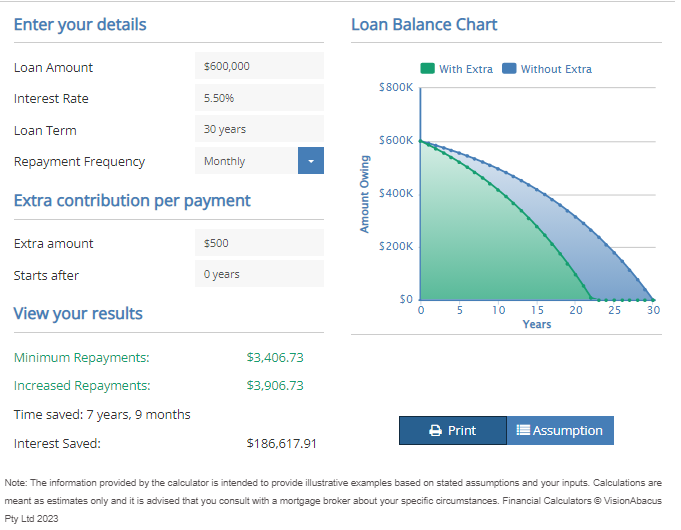

- Make Additional Repayments: Let’s say you have just taken out a loan a loan of $600,000 for 30 years and have an interest rate of 5.5%. If you pay just an extra $500 per month onto your loan then you can pay the loan off 7 years and 9 months sooner.

This alone will save you $186,617.91 in interest. To calculate how much you will save you can input your details here and see for yourself. You can use our free calculator here – Extra Repayment Calculator

Finding this extra money may be a stretch for some, for others it might be quite easy, but if you track your expenses and look for waste and bad deals you should be able to find some additional money to put on your mortgage each month. If you have other debts at higher interest rates, it will make sense to pay them off first or to consolidate your debts into your mortgage and use those payments as additional repayments on your mortgage.

If you need help calculating if this is the right path for you, then fill in the form and I’ll help you work it out based on your circumstances.

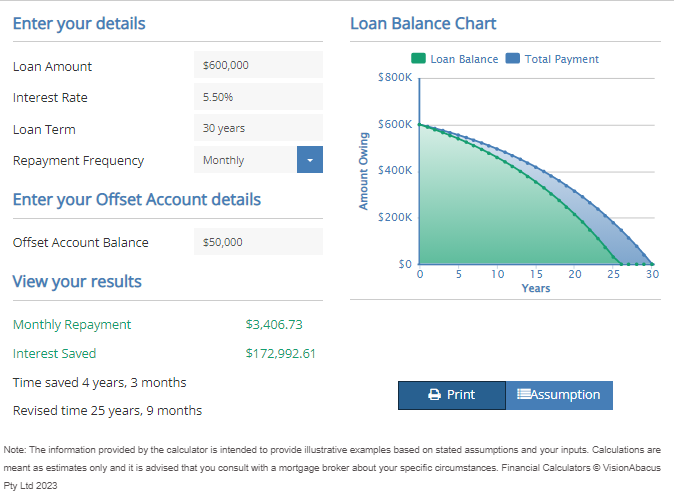

2. Add a 100% Offset Account: When you have a balance in your 100% offset account, that money counts against your mortgage balance while it is in there. Interest is calculated daily on most mortgages. Say you have $50,000 in your offset account from day 1 of your mortgage. Using the same $600,000 loan for 30 years at 5.5%. That $50,000 balance in your offset account will save you $172,992 in interest and pay your loan off 4 years and 3 months earlier.

The other way to use an offset account is to deposit your pay into your offset account, pay for everything on credit cards and then clear your credit card balance when it is due from your offset account. That keeps the balance in there higher for longer, saving you more interest which also means you are paying off more principal sooner, which lowers your interest further…

3. Lower Your Interest Rate: There are two ways to lower an interest rate on a mortgage – negotiate with your current lender (a free service we perform for our clients every year and monitor regularly) or we can find you a better rate by refinancing you to a more suitable loan. Surprisingly not all loans are well designed for being paid off early. So be sure to explain your goals when you talk to us.

If we were able to cut .5% off the interest rate off our example loan of $600,000 for 30 years reducing the rate from 5.5% to 5% then you would save 3.5 years and $75,103 in interest on your mortgage just by keeping your repayment the same as it was before the refinance.

If you want to pay off your home loan faster call 1300 661 211 or fill in the form below and we’ll organise a no-cost, no-obligation finance strategy session. We’ll look at what your options are to pay

off your loan.